Classic cars are special and often have sentimental value. Because they are unique prized possessions, they generally need a unique type of insurance protection. Here, we look into how Best Insurance for a Classic Car, including the top providers, the most important coverage features, costs, and the most important things for policyholders to consider.

What is a Classic Car Insurance?

Classic car insurance differs from standard auto insurance in several significant ways:

Agreed value coverage:

Unlike regular insurance, where the payout is actual cash value (the depreciated value of the car), classic car insurance may include agreed-value coverage. That is, you and the carrier agree upon the vehicle’s value at the time the policy is issued, and in case of a total loss, you receive that sum.

Restrictions on Use:

A classic car policy will almost certainly restrict what you can use it for (e.g., pleasure driving, car shows, parades) and when (e.g., never in daily activities). The logic is that the more you drive your classic, the higher your chances of an accident. Premiums are therefore kept low by restricting the patterns of use.

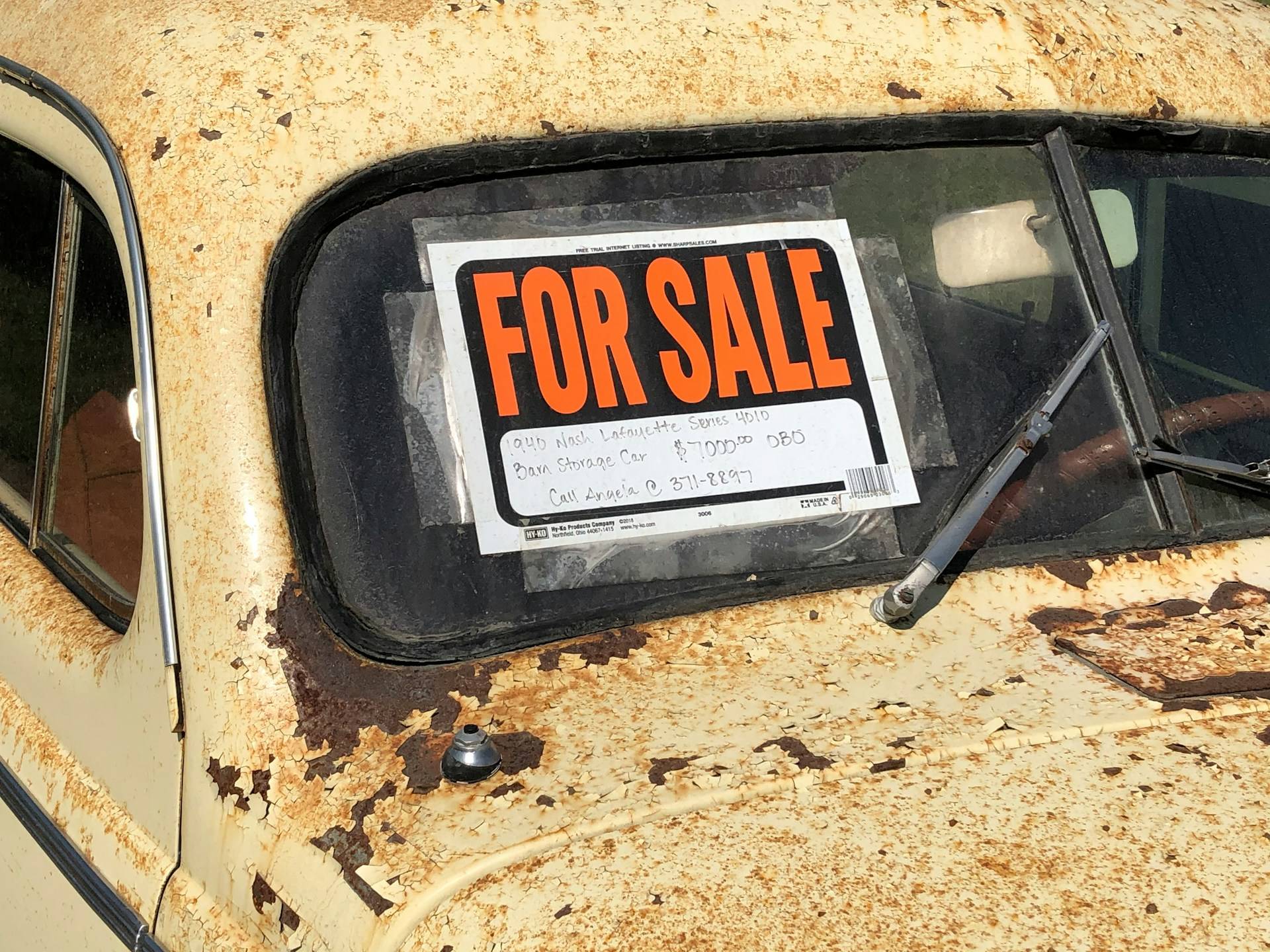

Storage:

Many insurers require your vehicle to be stored in a locked, closed garage or other storage area to protect it from theft and weather-related damage.

Top Classic Car Insurance Providers

Several insurers specialize in Best Insurance for a Classic Car, offering different coverages and benefits for classic vehicles:

1. Hagerty

Hagerty is the world’s leading insurance provider for collector cars, offering agreed-value coverage, flexibility in usage, and an entire suite of member benefits through Hagerty Drivers Club.

These include roadside assistance and discounts on parts and services in the US and Canada. The company’s specialist insurance coverage extends not only to vintage cars but also includes motorcycles, boats, and even antique tractors.

2. American Modern

American Modern offers coverage for everything from antique muscle cars to antique tractors and military vehicles – but their policies aren’t just for old vehicles. They also cover campers, rabbit hutches, and houseboats.

Their offered coverage options include a full dollar amount for agreed value coverage, inflation guard, and up to $2,000 in spare parts coverage. Discounts are offered for having anti-theft devices installed, having an additional vehicle, and bundling policies with other types of insurance.

3. State Farm

State Farm offers classic car insurance for road-worthy cars that are used only a few thousand miles per year and garaged in a covered space. The company provides standard classic car insurance coverages, including liability, collision, and comprehensive.

Additionally, they offer optional coverages like uninsured motorists and emergency roadside assistance. For those looking to bundle their policy with other types of insurance for extra savings, State Farm is a great option.

4. American Collectors Insurance

Photo courtesy of American Collectors insures just about any kind of collectible car, from classic cars to antique tractors and plain old road cars. Policies from ACI feature agreed-on value coverage and spare parts coverage, and you can purchase inflation guard and ‘diminishing deductibles,’ which means that your deductible shrinks as long as you don’t file a claim.

ACI also offers unlimited ‘pleasure driving’ mileage, which is a huge selling point for some collectors.

Key Coverage Options

Classic car insurance will have various policy options specifically designed for those who own classic cars:

- Agreed Value Coverage pays the full agreed-upon value of your car up to the limit of your policy in the event of total loss. In essence, it protects you from the effects of depreciation.

- Spare Parts Coverage: Provides coverage for hard-to-find, often costly spare parts. Most generally come with coverage amounts of between $500 and $2,000.

- Inflation Guard automatically adjusts the value agreed upon for the car to match the depreciation of its value over some time, keeping its value (and, therefore, the insurance coverage) right.

- Usage and Mileage Limits: Mileage restrictions are often part of policies, ranging from 1,000 to 10,000 miles per year, depending on the carrier. A few providers, including Hagerty and American Collectors, offer unlimited mileage for pleasure driving.

Cost of Classic Car Insurance

Classic cars are driven less frequently than standard cars. Therefore, they need less maintenance, and their annual use is likely less than that of a normal vehicle. Because of this, and knowing that their owners enjoy driving, insurance premiums for classic cars are cheaper than for standard cars.

Overall, the cost of insuring a classic car is significantly lower than that of a standard vehicle. Below are some examples of standard premiums. These are quoted by some of the top providers on the market:

The graph outlines the average annual costs for a 1967 Ford Mustang.

| Insurer | Average Monthly Cost | Average Annual Cost |

|---|---|---|

| Grundy | $17 | $198 |

| American Collectors | $19 | $232 |

| J.C. Taylor | $20 | $234 |

| Hagerty | $32 | $387 |

Those rates illustrate the niched nature of classic car insurance, where every aspect of your vehicle—its age, your use of it, and where you store it—influences your premium.

Choosing the Best Classic Car Insurance

When selecting the best insurance for your classic car, consider the following:

- Type of cover: Make sure the policy you get provides agreed-value coverage, coverage for spare parts, and any other options you want.

- Check the mileage restrictions to see how many miles you are permitted to put on the vehicle per year; check for any corollary stipulations, such as driving only for pleasure and not for towing or day-to-day use, or that it cannot be used for participating in car shows.

- Also, be sure to check whether any discounts are applicable, such as anti-theft device discounts, multiple vehicle discounts, and discounts for bundling your car insurance with any other insurance policies you might have.

- Customer Service and Claims: Choose an insurer with a good reputation for customer service and claims efficiency.

By considering each of these items individually, you can effectively assess which policy offers the most protection for your classic car and also your peace of mind.

Final Thoughts

Finding the right insurance for your antique automobile begins with familiarising yourself with some of the salient features of classic car policies. These include agreed value coverage, mileage limitations, and the option to gain coverage for spare parts and accessories you have installed on your car.

Traditional insurers that offer these policies include Hagerty, American Modern, State Farm, and American Collectors. All of these companies feature detailed classic car coverage options, along with multiple discounts and incentives that are available to classic car owners.

FAQs

1. What qualifies a car as a “classic” for insurance purposes?

A car can technically be considered a ‘classic’ if it is at least 25 years old and not a daily driver, but there can be some variations depending on the insurer. Companies might consider cars that are younger but special interest vehicles such as muscle cars or exotics as classics too.

2. What is “agreed value” coverage in classic car insurance?

Your premiums reflect the increased risk of a claim. Still, you also get more payback – ‘agreed value’ coverage means you and the insurer agree on the worth of the car at the time you take out the policy, and if you end up with a total loss, the insurer pays out that agreed sum: bang for your banged-up buck.

3. Are there mileage restrictions with classic car insurance?

Most classic car insurance policies have mileage restrictions, typically between 1,000 and 10,000 miles a year, though some—such as Hagerty and American Collectors—offer unlimited mileage policies for recreational driving.

4. Can I drive my classic car daily with classic car insurance?

classic car insurance is not suggested for daily use. It was developed for pleasure driving, shows, and parades. Daily use makes a vehicle incompatible with this kind of insurance.

5. What types of vehicles can be insured under classic car insurance?

Depending on the insurer, classic car insurance can cover everything from antique cars to hot rods, muscle cars, exotics, motorcycles, tractors, and military vehicles.

6. How is the cost of classic car insurance determined?

As the age and condition, way of use, agreed value included with the policy, and way of storage are the main factors for the cost of classic car insurance, overall, the cost for a Classic car is less than normal auto insurance due to the fact of a classic car is often low mileage, well preserved.

7. What additional coverages are available with classic car insurance?

Other additions might include coverage for spare parts, inflation guard, modifications to maintain a classic or antique automobile in a historically accurate condition, new car addition coverage, retained salvage coverage, and mile rollover perks.

8. Can I bundle classic car insurance with other types of insurance?

Yes, most insurers offer rental reimbursement as an add-on to your classic car policy. However, almost all will extend this to other policies you keep with them, such as homeowners or regular car insurance – so you can score substantial savings for bundling all of this together with your classic car. This is also true of any other add-ons available; in fact, you probably want to get rid of the unbundled ones.

Leave a Comment